Personal information

What should I bring? Let’s start with the basics:

- Last year’s taxes, both your federal and — if applicable — state return. These aren’t strictly necessary, but they’re good refreshers of what you filed last year and the documents you used.

- Social Security numbers for yourself, your spouse and all dependents. Remember, in addition to children, dependents can include elderly parents and others.

Income

Gather all the documents that confirm the money you received during the previous year.

- W-2 forms. Employers must issue these by Jan. 31, so keep an eye on your mailboxes, both physical and electronic.

- 1099 forms. Each of these ends with a different suffix, depending on the type of payment you received. For example, form 1099-MISC is for contract work. If you’re paid via a third party such as PayPal or Amazon, you’ll likely get a 1099-K. Investment earnings show up on 1099-INT for interest, 1099-DIV for dividends and 1099-B for broker-handled transactions.

Deductions

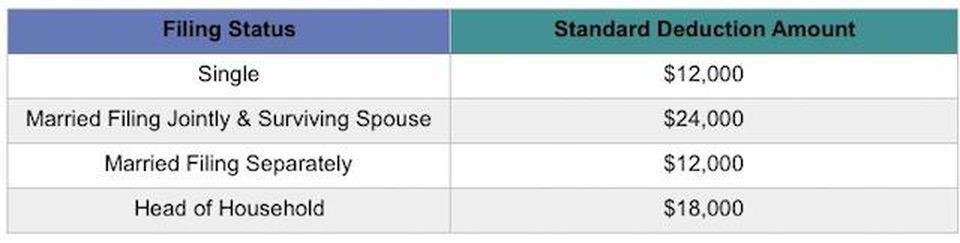

Big changes this year in this department. The standard deduction has nearly doubled so that means many people may not be itemizing their deductions.

Here are the new figures for 2018 federal filing:

Deductions help reduce your taxable income, which generally means a lower tax bill. The key to claiming deductions is documentation — not only can it protect you if you’re ever audited, it can cut your tax bill by helping you remember what to claim. Gathering those records may take time, but it can pay off, saving you money.

You don’t have to itemize to benefit from some deductions. These are listed directly on Form 1040 or, to a lesser extent, on Form 1040A. More deductions are available if you itemize expenses on Schedule A.

Here’s a rundown of some popular tax deductions:

**Make sure you have documentation for each before you file**

- Retirement account contributions. You can deduct contributions to a traditional IRA or self-employed retirement account. Just be sure to stay within the contribution limits.

- Educational expenses. Students can claim a deduction for tuition and fees they paid, as well as for interest paid on a student loan. The IRS won’t accept your deduction claim without Form 1098-T, which shows your education transactions. Form 1098-E has details on your student loan.

- Medical bills. Medical costs could provide tax savings, but only if they total more than 7.5% of adjusted gross income for most taxpayers.

- Property taxes and mortgage interest. If your mortgage payment includes an amount escrowed for property taxes, that will be included on the Form 1098 your lender sends you. That document will also show how much home loan interest you can claim on Schedule A.

- Charitable donations. To ensure your generosity pays off at tax time, keep your receipts for charitable donations. The IRS could disallow your claim if you don’t have verification.

- Classroom expenses. If you’re a school teacher or other eligible educator, you can deduct up to $250 spent on classroom supplies.

- State and local taxes. You can deduct various other taxes, including either state and local income or sales taxes. You don’t need receipts for the sales tax; the IRS provides tables with average amounts you can claim. The tax on a major purchase, however, can be added to the table amount, so keep those receipts.

Note that state income taxes paid should be on your W-2, but remember to add any state estimated taxes you paid during the year.

Credits

Credits are deductions’ more valuable cousins: They provide dollar-for-dollar cuts in any tax you owe. But as with deductions, you need documentation to claim them. Here are some popular tax credits:

- American Opportunity and Lifetime Learning credits. These education-related credits can save you quite a bit of money. As with the tuition and fees deduction, Form 1098-T is required to claim either.

- Child Credit. The standard Child Credit is worth up to $1,000 per child dependent for the 2017 tax year. If you added to your family through adoption, you might be eligible for additional tax credits.

- Premium Tax Credit. If you bought Affordable Care Act coverage through the government’s marketplace, be on the lookout for Form 1095-A. It will help you claim the Premium Tax Credit or reconcile the amount you got in advance.

- Retirement savings contributions credit (also known as the Saver’s Credit). Contributions to a 401(k), similar employer-sponsored plan or an IRA might allow you to claim this credit.

Payments

Most of us have income taxes withheld from our paychecks to cover our tax liabilities; that amount is on our W-2 forms. But if you made federal estimated tax payments during the year, have this amount handy, too.

This tax checklist covers preparation issues common to most filers, but taxes are different for each of us. Be prepared to tailor the list above to your situation.

CLICK HERE FOR LINK TO PRINTABLE TAX PREP CHECKLIST

Tina Orem contributed to this article.